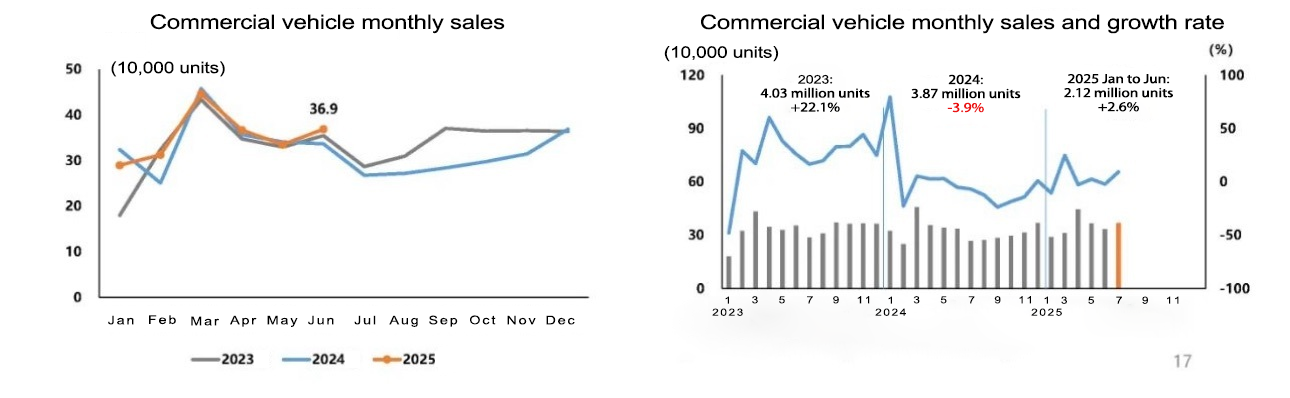

Commercial Vehicles Sales Grow 2.6% YoY in H1 2025, with Divergent Performance Across Segments

Date: 2025-07-14 Categories: News Hits: 280

In July 2025, the China Association of Automobile Manufacturers (CAAM) released auto production and sales data for the first half of the year. Supported by macroeconomic policies, the continuous effectiveness of trade-in policies, and the rapid development of new energy vehicles, the auto market maintained a sound momentum, with commercial vehicles achieving steady growth.

From January to June 2025, commercial vehicles sold 2.122 million units, up 2.6% year-on-year (YoY); production reached 2.099 million units, up 4.7% YoY. In June alone, commercial vehicle production and sales were 354,000 units and 369,000 units respectively, up 5.3% and 10.3% month-on-month (MoM), and 7.1% and 9.5% YoY, maintaining a stable growth trend. However, natural gas commercial vehicles performed relatively weakly: 17,000 units were sold in June, down 5.6% MoM and 22% YoY; cumulative sales in H1 reached 118,000 units, down 10.1% YoY.

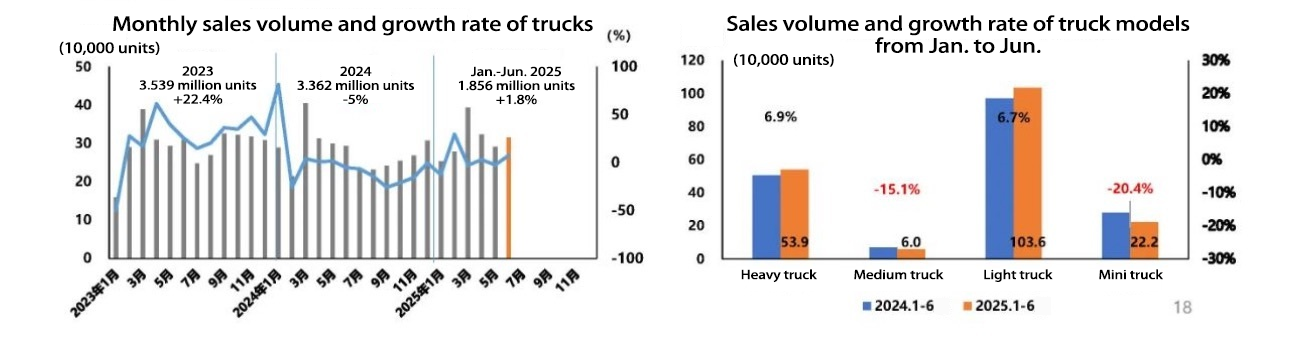

Among sub-models, trucks remained the mainstay of the commercial vehicle market. In H1, trucks sold 1.856 million units, up 1.8% YoY. Heavy trucks performed notably, with 539,000 units sold in H1 (up 6.9% YoY), and light trucks sold 1.036 million units (up 6.7% YoY). However, medium trucks and micro trucks saw declining sales, at 60,000 units (down 15.1% YoY) and 222,000 units (down 20.4% YoY) respectively. In June, truck production and sales were 304,000 units and 316,000 units, up 4% and 8.5% MoM, and 4.7% and 7.5% YoY. Heavy trucks sold 98,000 units in June, up 10.2% MoM and 37.1% YoY, becoming a key driver of truck growth.

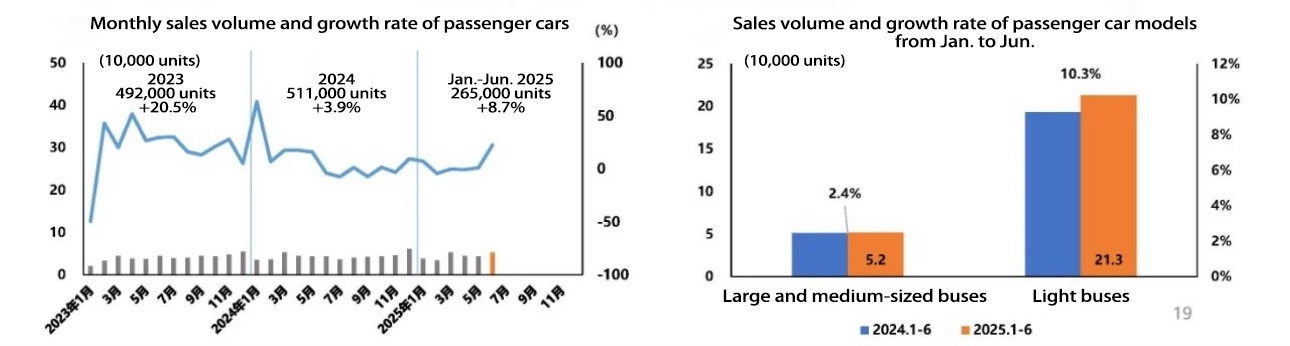

The bus market showed more significant growth, with cumulative sales of 265,000 units in H1, up 8.7% YoY. Among them, light buses sold 213,000 units (up 10.3% YoY), and large and medium-sized buses sold 52,000 units (up 2.4% YoY). In June, bus production and sales were 50,000 units and 53,000 units, up 14.2% and 22.6% MoM, and 24.1% and 22.6% YoY. The monthly sales of large/medium buses and light buses rose 17.1% and 24.4% YoY respectively, showing strong growth.

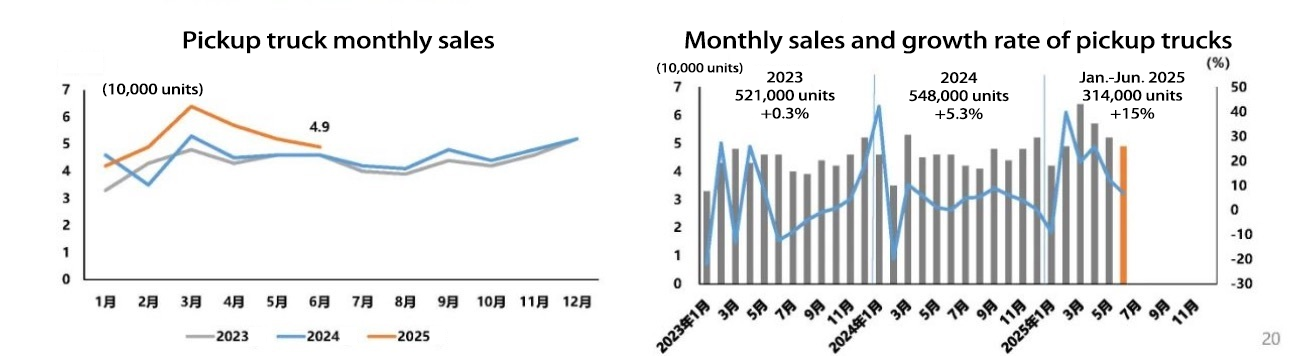

The pickup truck market was also active, with cumulative sales of 314,000 units in H1 (up 15% YoY) and production of 309,000 units (up 20.5% YoY). By fuel type, diesel pickups were more popular, with sales of 194,000 units in H1 (up 5.6% YoY), while gasoline pickups sold 75,000 units (down 8.1% YoY). Market concentration increased: the top five pickup manufacturers sold 218,000 units in H1, accounting for 69.5% of total sales, up 1.8 percentage points from the same period last year.

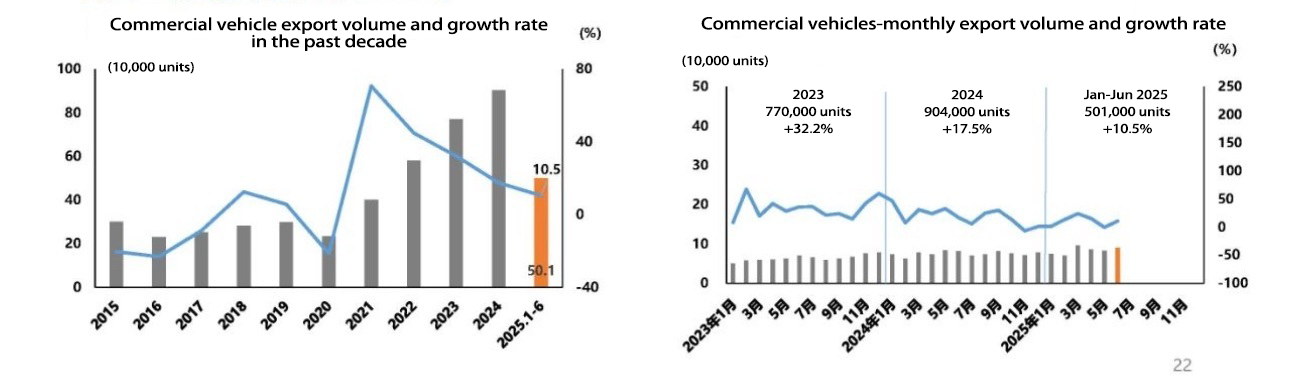

In terms of exports, the overseas market for commercial vehicles continued to expand. In H1, 501,000 commercial vehicles were exported, up 10.5% YoY, including 430,000 trucks (up 10.5% YoY) and 71,000 buses (up 10.8% YoY). In June, 90,000 commercial vehicles were exported, up 8.3% MoM and 10.6% YoY, with truck and bus exports reaching 76,000 units and 14,000 units, up 8.3% and 25.2% YoY respectively.

Looking ahead to H2, the steady implementation of "new energy and new technology" policies, coupled with the continuous launch of new products by enterprises, is expected to drive commercial vehicle consumption. However, challenges such as the phasing out of new energy vehicle purchase tax exemptions, intensified industry competition, and profit pressures remain. It is believed that stabilizing policy expectations and regulating market order will be crucial to promoting the healthy and steady development of the industry.

G200 Hybrid MPV – Versatile & ...

G200 Hybrid MPV – Versatile & ...  G050 - The Best Choice for Urb...

G050 - The Best Choice for Urb...  Wuling Golden Card - Luxury, S...

Wuling Golden Card - Luxury, S...  Ruichi EC75 – Modern 2-Seater ...

Ruichi EC75 – Modern 2-Seater ...  Saic Motor Wuling Yangguang – ...

Saic Motor Wuling Yangguang – ...  Saic Datong person with power ...

Saic Datong person with power ...  Brilliance Xinyuan E3L – Advan...

Brilliance Xinyuan E3L – Advan...  Jinhu EV48 – Efficient Electri...

Jinhu EV48 – Efficient Electri...  V5 – High-Performance 2-7 Seat...

V5 – High-Performance 2-7 Seat...  King Long European Version Lig...

King Long European Version Lig...  FM Oley – Robust Commercial Va...

FM Oley – Robust Commercial Va...  Dongfeng Capstar – Versatile 3...

Dongfeng Capstar – Versatile 3...  FOTON LINGHANG M5 – Spacious S...

FOTON LINGHANG M5 – Spacious S...  Geely Farizon H8E - The Ultima...

Geely Farizon H8E - The Ultima...  Dongfeng EV350 - Leading the W...

Dongfeng EV350 - Leading the W...  BYD T5 - Revolutionize Your Co...

BYD T5 - Revolutionize Your Co...  Geely Farizon F1e - The Ideal ...

Geely Farizon F1e - The Ideal ...  Dongfeng EV150 - Your Ideal El...

Dongfeng EV150 - Your Ideal El...  UFO Aochi - Unveiling the Myst...

UFO Aochi - Unveiling the Myst...  DFAC Captain - Unleashing the ...

DFAC Captain - Unleashing the ...  SRM-T52 - Versatile and Effici...

SRM-T52 - Versatile and Effici...  SRM-T50 Electric Vehicle - You...

SRM-T50 Electric Vehicle - You...  SRM-S22 - Advanced and Reliabl...

SRM-S22 - Advanced and Reliabl...  SAIC Maxus Interstellar L – 5-...

SAIC Maxus Interstellar L – 5-...  Great Wall Fengjun 5 – Reliabl...

Great Wall Fengjun 5 – Reliabl...  Zhengzhou Nissan Ruiqi 7 – Pow...

Zhengzhou Nissan Ruiqi 7 – Pow...  Chongqing Changan Lantuo Zhe –...

Chongqing Changan Lantuo Zhe –...  JAC T8PRO Rui Xing Edition – 5...

JAC T8PRO Rui Xing Edition – 5...  CNG S6 - 2.0L: The High - Perf...

CNG S6 - 2.0L: The High - Perf...  CNG Ruihang M60: Your Green an...

CNG Ruihang M60: Your Green an...  CNG Ruihang M80: The Ideal CNG...

CNG Ruihang M80: The Ideal CNG...  CNG S6 - 1.6L: Your Economical...

CNG S6 - 1.6L: Your Economical...  CNG Wuling - Xinka: The Effici...

CNG Wuling - Xinka: The Effici...  SY335BH 33T Excavator | SANY H...

SY335BH 33T Excavator | SANY H...  Qingdao Jiefang HanV 320HP 8X4...

Qingdao Jiefang HanV 320HP 8X4...  SAC9000C8-8 All-Terrain Crane ...

SAC9000C8-8 All-Terrain Crane ...  18T Pure Electric Compression ...

18T Pure Electric Compression ...  TEG5180GSSADFBEV1 Electric Wat...

TEG5180GSSADFBEV1 Electric Wat...  XCMG XGH5180TXCLBEV Pure Elect...

XCMG XGH5180TXCLBEV Pure Elect...  ZLF5290GXFPM120 Foam/Water Tan...

ZLF5290GXFPM120 Foam/Water Tan...  Tenglong Ambulance SYC5040 XJH...

Tenglong Ambulance SYC5040 XJH...  Chengli Jiefang J6 8x4 Aluminu...

Chengli Jiefang J6 8x4 Aluminu...  Feidian W5 163HP 4X2 Refrigera...

Feidian W5 163HP 4X2 Refrigera...  Zongshen ZS500ZH-9 3-Wheeled M...

Zongshen ZS500ZH-9 3-Wheeled M...  Zongshen ZS500ZH-3S 3-Wheeled ...

Zongshen ZS500ZH-3S 3-Wheeled ...